Jim is regularly published in various tax industry publications and news articles. Most of the articles from Jim are listed below.

Browse published articles by IRS problem topic:

- IRS Audits (mail, office and field audits)

- IRS Collection issues and options

- IRS Penalties (abatement and procedure)

- Late/nonfiling (procedures, best practices, penalties)

- Underreporter Notices (CP2000s, matching notices, 1099-K matching)

- Dealing with the IRS (transcripts, tax identity theft, getting information from the IRS, etc.)

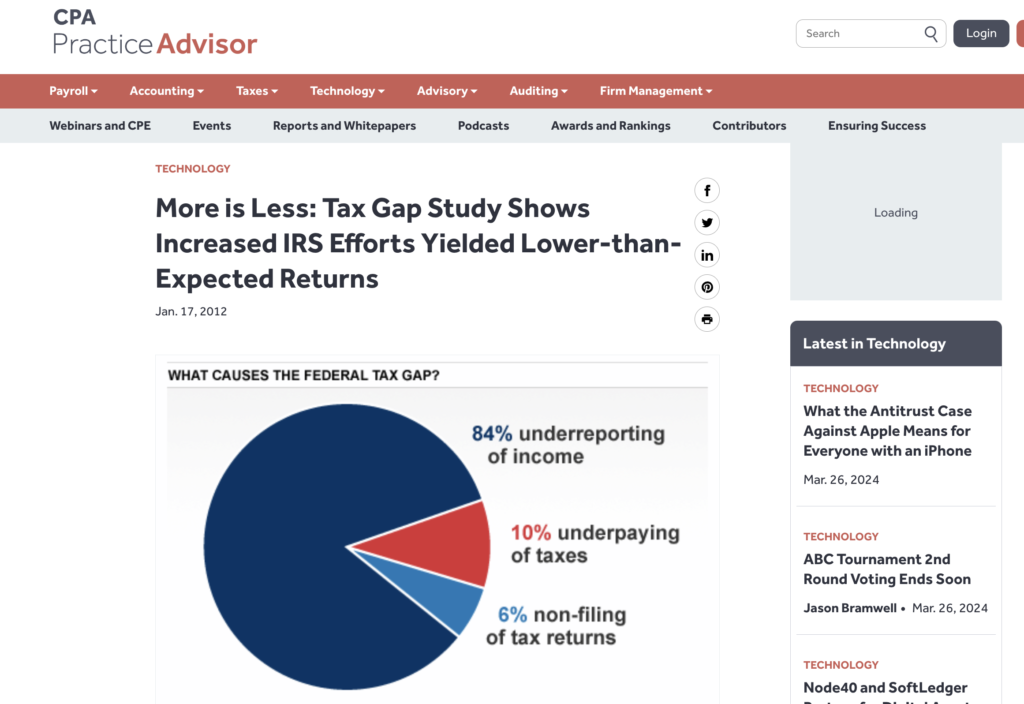

- Tax Administration (tax compliance issues, IRS procedures, future of IRS, IRS Policy)