Tax pros can use IRS e-services to get information and help their clients, especially with a tax problem. Here are my eight suggestions for the IRS to improve e-services. This article was highlighted by the Taxpayer Advocate in her annual report to Congress and many suggestions were also included in the 2014-2016 IRS Electronic Tax Administration Advisory Committee recommendations that I chaired for the 2015 and 2016 report years.

The impact of underfunding the IRS

Many years of IRS budget cuts have put a damper in IRS customer service, access to your IRS information, and to compliance activity. The IRS has not lost a beat though. Compliance activity- and results- continue to increase. But the long term impact will be that the IRS will not provide the services needed for its taxpayers- and get to secure, online taxpayer accounts that will help taxpayers get their tax information and interact with the IRS easier. This AICPA CPA Insider article explores 5 sobering facts of IRS budget cuts.

More is Less: Tax Gap Study Shows Increased IRS Efforts Yielded Lower-than-Expected Returns

The tax gap is the amount of tax dollars lost to the US Treasury each year due to taxpayer noncompliance. The tax gap is almost a ½ a trillion dollars a year. The IRS is tasked with closing the tax gap. This CPA Practice Advisor article shows the increase in compliance activity to close the tax gap.

Tougher IRS Compliance Practices Mean Big Changes for Practitioners

My 2011 Accounting Today article on how the IRS has changed to a more efficient compliance enforcement organization by use of notices – which can touch many more taxpayers than audits and face-to-face interactions.

Are your clients bypassing you after tax season?

A part of being a year-round trusted tax advisor is helping your clients if they have a tax problem. In this AICPA CPA Insider article, I outline how many taxpayers have a tax problem and what assistance they need from their tax pro.

IRS ACA Compliance: IRS Signals ACA compliance issues for 2015

My co-authored Tax Adviser article outlining the IRS compliance activity for the Affordable Care Act (i.e. ACA or “Obamacare”). Many issues regarding checking for adequate coverage and appropriate compliance to receive the advanced premium tax credit.

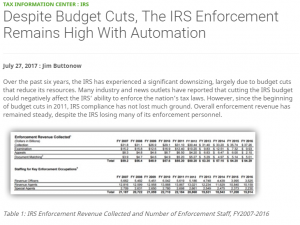

Despite Budget Cuts, The IRS Enforcement Remains High With Automation

My H&R Block article on the reasons why we still see high IRS compliance activity despite years of IRS budget cuts: the IRS is doing more with less by using automation and information matching for better compliance.

Be ready to answer these Affordable Care Act questions

An AICPA CPA Insider article that I co-authored regarding common Affordable Care Act (ACA or “Obamacare”) tax questions.

Why the IRS isn’t giving up on compliance and enforcement

The IRS loses almost 1/2 trillion tax dollars each year (called the “tax gap”) due to noncompliance. My AICPA CPA Insider article on 5 reasons why the IRS is not giving up on enforcing the tax laws.

1099-K matching, small business audits, and tax identity theft

My articles in CPA Practice Advisor on how CPAs can do better serving clients with tax problems, 1099-K matching issues in IRS audits/notices of small businesses, and IRS identify verification issues and advice to help clients.